NEW 2024

Компания TkV специализируется на решении задач в области продаж, поставок, проектирования, монтажа и сервисного обслуживания систем вентиляции и кондиционирования для Вашего дома и промышленных объектов.

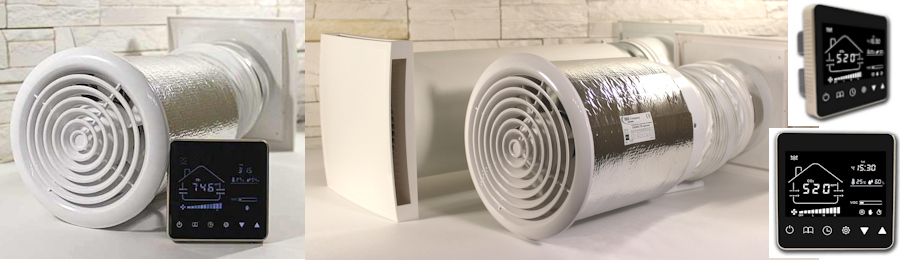

Наша компания «TkV Company» (Россия) является производителем компактных вентиляционных установок САЛЮС. А так же является официальным представителем компании и продукции «FANZIC» (КОРЕЯ) на территории России.

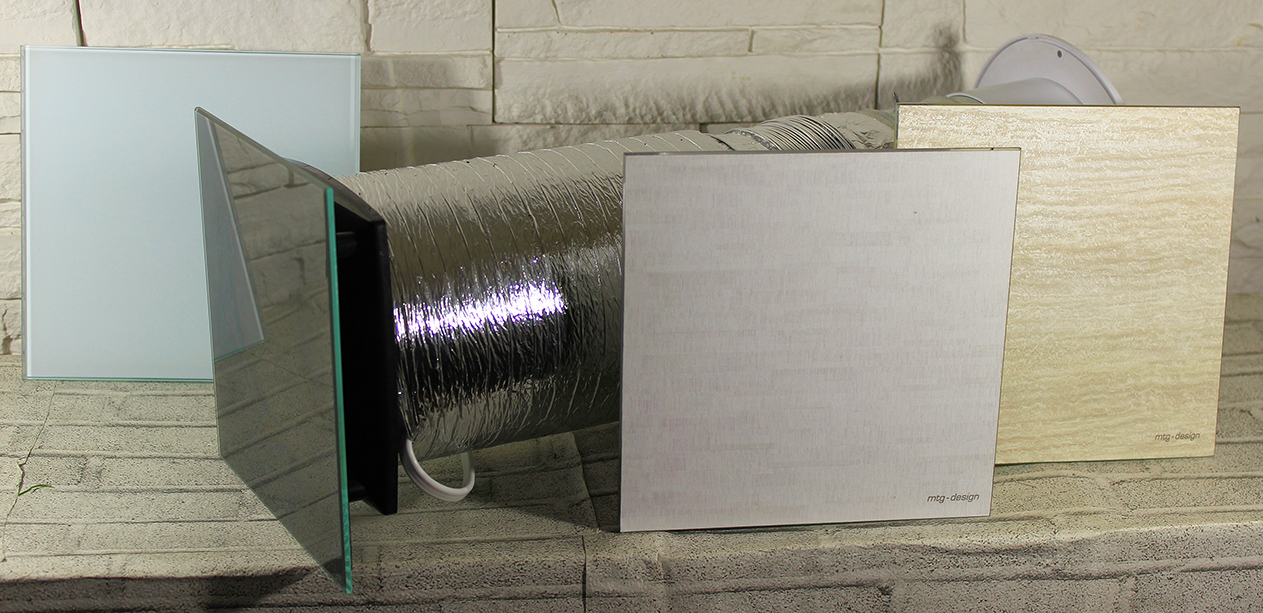

Новые панели для компактных вентиляционных установок серии САЛЮС TkV-03.

|

от 22 000 руб |

от 24 000 руб |

САЛЮС TkV-03 RF (RF-2) (Сибирь)

от 25 000 руб |

|

от 28 000 руб |

от 30 000 руб |

|

от 27 000 руб |

от 28 000 руб |

САЛЮС TkV-05 RF (RF-2) (Арктика)

от 29 000 руб |

|

от 31 000 руб |

от 34 000 руб |

Представлены рекомендуемые розничные цены с 01.09.2023 года.

Гибкая система скидок для постоянных клиентов и участников партнерской программы.

Специалисты компании осуществляют проектирование, монтаж, пусконаладочные работы, а также производят сервисное обслуживание различных климатических систем. На Ваш выбор представлены системы кондиционирования Daikin, Fujitsu, Panasonic, McQuay, Aermec S.P.A., General Climate и других производителей.

Мы предлагаем широкий выбор климатической техники для контроля и создания необходимого микроклимата ведущих производителей Dantherm, Carel, Hoval, Cotes, Frivent, Aerial. Наши специалисты помогут Вам подобрать осушители, очистители, увлажнители и ионизаторы воздуха, а так же различные системы автоматизации.

На всю продукцию компании и все выполненные работы по установке и наладке оборудования и систем мы предоставляем гарантию от 1 до 5 лет. Если в течение гарантийного срока были выявлены производственные дефекты оборудования, мы обязуемся бесплатно устранить любые неполадки. Наши специалисты смогут произвести работы в любое удобное для Вас время.

Качество предлагаемого продукта, профессионализм персонала и уникальность предложений с оптимальным сочетанием «цена-качество» обеспечивают стабильный рост компании.